Health & Dental Plans

Alberta

We are a premier provider of Stand-Alone "Health Spending Accounts" in Alberta and across Western Canada

What is a Private Health Service Plan?

A Health Spending Account technically a Private Health Service Plan, is a self insured, Health & Dental Plan approved by the Canada Revenue Agency in 1987 (Subsection 248(1)) to put self employed business owners on equal footing with larger companies who have the ability of providing Tax Free Benefit Plans allowing a non-taxable reimbursement for employees (and their dependents).

In simple terms a Health Spending Account is a Health & Dental Plan that allows business owners to pay for theirs, their dependents, and their employees medical and dental expenses with Pre-Tax Corporate Income versus After-Tax personal income reducing your health and dental costs by as much as 40 percent depending on the individual’s marginal tax rate.

Our benefit plan outlays are a tax deductible business expense while claim proceeds are received tax free.

Health Spending Accounts

We offer 4 customizable plans to ensure there is a program suitable for every type of business entity and corporate structure with employees, regardless of the size of the business or if there is an existing benefit plan.

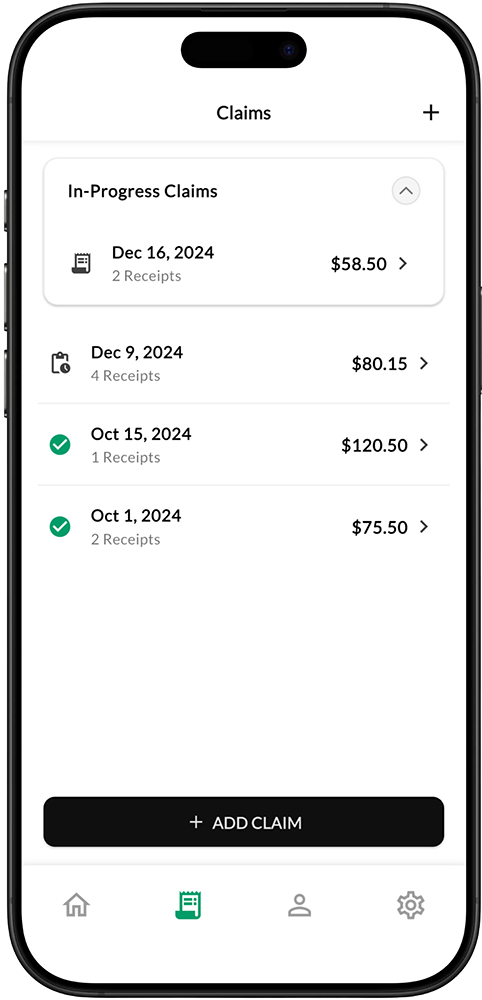

How it works?

Employee Group Benefit Plans

Randy has over 30 years’ experience working with successful business owners, professionals and executives in the design, implementation and support of employee benefit plans & comprehensive risk management, estate, and life & health insurance solutions.

Click here to learn more

easyplans HEALTHCARE

We are your solution for finding the right health and dental plan for you and your family. We understand that choosing a benefits plan can be complicated and overwhelming. Let us do the work for you.

Click here to learn more

Insurance Solutions

While many business owners have had success growing their business, this does not necessarily mean that they will have success protecting their business, or financially securing the value of their business.

Helping you protect what's most important to you