What’s Most Important?

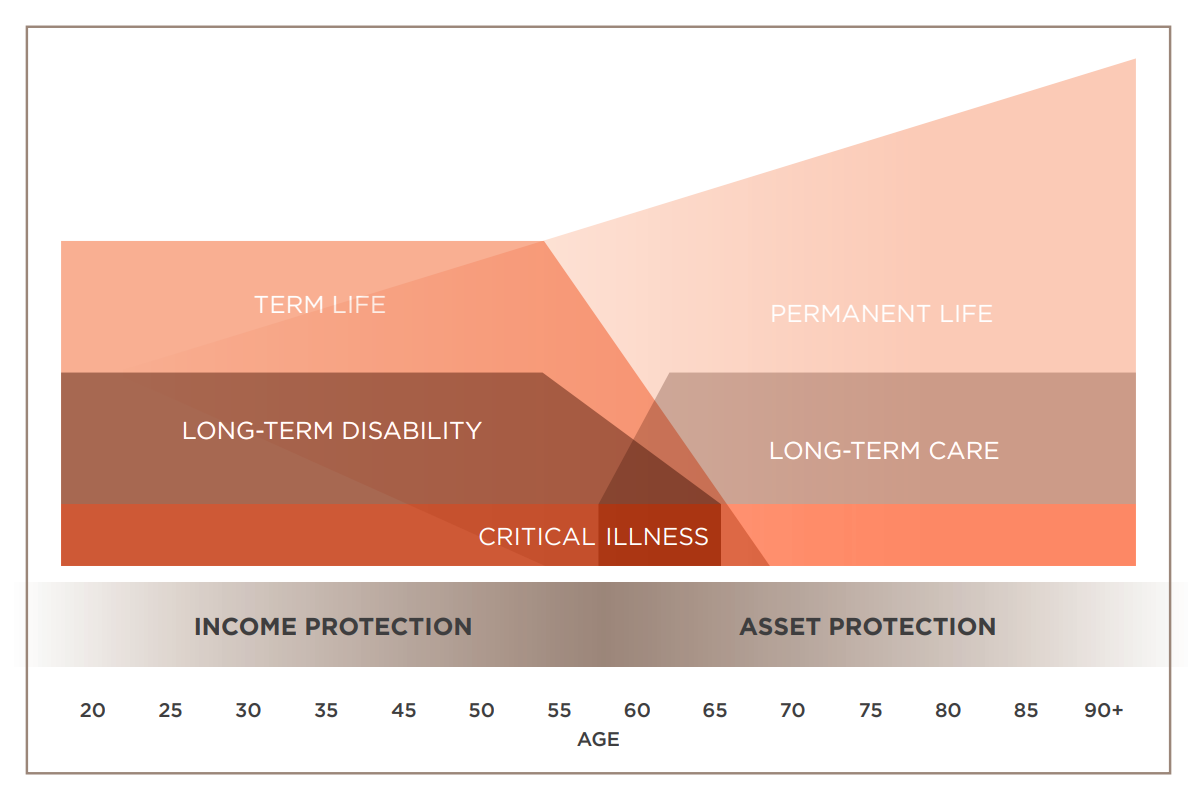

Income Protection

Your largest asset is your ability to earn an income. It is important that you protect this asset, while you are building your net-worth, from illness, injury, and early death.

A rule of thumb is to allocate up to 5% of your income to protecting your income.

Asset Protection

Assets are at risk of erosion due to annual taxation and taxation within your estate. You can protect, preserve, and enhance these assets with effective insurance and estate planning strategies.

These are strategies that complement and enhance traditional investing, they don’t replace them.